More from Vietnam

More from Vietnam

Vietnam ranked 103 out of 144 for financial service readiness in the 2015-2016 World Economic Forum's (WEF) Global Competitiveness Report. At that time, seventy-three percent of the Vietnamese population did not have a bank account and only twenty-five percent of the population had a basic understanding of financial literacy. That rate is even lower in rural areas, especially amongst women.

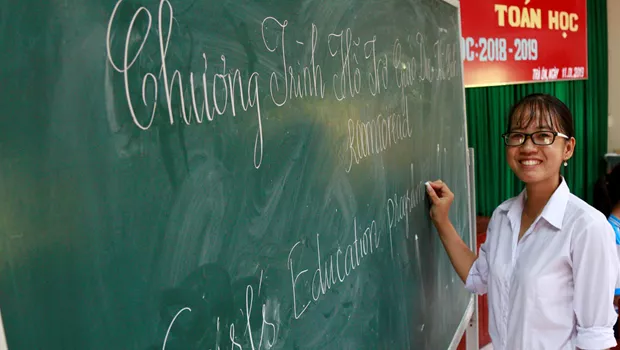

At school, financial literacy is not an official subject and Vietnamese girls rarely learn the basics of saving. However, when girls learn more about the basics of budgeting as part of Room to Read's Girls' Education Program, everything begins to change.

The power of piggy banks

Before leaving for work, social mobilizer, Ms. Tho Le puts a new friend in her purse, a piggy bank. This plastic figurine is a key component of today’s life skills class on “How to save money.”

Ms. Tho starts the class with her own story, sharing her own methods for saving in daily life. Her personal anecdote quickly perks the students’ attention since they rarely hear how an adult uses her own money.

Next, the girls discuss a sample budget for the month and allocate daily meals, transportation, clothes and beauty products. They separate these costs into two categories: Needs and Wants.

The girls soon learn food and transit fall in the Need group, while buying new clothes and cosmetics remain Wants. To save money, the girls trim the Wants to create a more reasonable budget. Later students map out a savings plans to buy a dream item. Some seek a new backpack or bicycle, while others even talk about saving for university tuition.

“I want to save money to buy a ukulele since I really love music. It costs USD $20. If I can save 50 cents every day, it will take 40 days to get an instrument by this summer,” says Hanh Ha, a program participant.

After carefully reviewing their budget, many girls are surprised at where their money goes.

“I have tried to save money plenty of times, but I do not know why it keeps disappearing. When I wrote down everything in detail today, I saw that I spent a lot of money for snacks, birthday gifts for friends and unnecessary new stationary. I came to realize that it is important to save money patiently, so one day I will get what I really want,” says Thu Nguyen, an 8th grade student.

Exploring financial literacy from all angles

From grade 7 through 12, girls study a range of financial literacy courses designed to align with their conditional growth and needs as part of Room to Read's Girls' Education Program. The courses are contextualized to fit with the local context and specific characters of the school girls in each area.

In many regions in Vietnam, especially agricultural communities, people face financial difficulties due to fluctuating weather (floods, hurricanes, drought, etc.) and already have a strong habit of saving. Many children learn about saving, yet lack an understanding of what financial management and investing means.

Beyond the life skills sessions, girls also learn about financial literacy through group discussions, exposure to women-owned businesses and visits to local banks. These opportunities help girls better understand financial management as career options.

Students also learn how to open ATM cards, manage their own bank accounts and learn about loan services designed for disadvantaged students in remote areas.

The combination of resources gives girls tangible ways to reap the benefits of these lessons in their daily life.

"Last year, after studying the lesson 'How to save money,' I started saving more. Every day, I have saved 20 cents. This year, I have had enough money to pay for the school trip plus an extra USD $15 of savings," says Yen Truong, a girl in 9th grade at Long Hau lower secondary school.

Expanding our financial literacy curriculum

Knowing financial literacy is a fundamental to future success, Room to Read and Credit Suisse recently partnered to pilot a new curricula to deepen our Girls’ Education Program participants’ knowledge about a range of money matters.

This new endeavor offers financial education life skills (FELS) clubs to 28 schools in Sri Lanka and Tanzania and teach girls about topics such as saving, needs versus wants and creating a business plan.

The newly piloted program began in early 2018 thanks to Credit Suisse, a key partner in funding the development of the materials, and Aflatoun International, a leading expert in financial skills programs.

Invest in children's education today.